When you think of celebrity lifestyles, images of red carpets, private jets, and luxury sports cars likely come to mind. From sleek Ferraris to custom Rolls-Royces, the rich and famous often own vehicles worth more than the average person’s home. But what many don’t realize is that these high-value cars require specialized insurance coverage — not the standard policy most people carry.

Celebrities and high-net-worth individuals have unique risks when it comes to their cars, including theft, vandalism, paparazzi damage, and even the occasional overzealous fan. That’s where celebrity car insurance comes into play — a tailored protection plan designed for their exclusive needs.

In this article, we’ll take a closer look at how celebrities insure their luxury rides, what makes these policies different, and what lessons everyday drivers can take from their approach. Whether you’re a car enthusiast or just curious about how the elite protect their investments, this guide offers a fascinating peek under the hood.

Why Celebrities Need Specialized Car Insurance

Luxury and exotic cars are not just expensive — they’re also unique in design, materials, and performance. A typical auto insurance policy isn’t built to cover vehicles worth hundreds of thousands (or even millions) of dollars.

Here’s why celebrities turn to specialized policies:

1. High Vehicle Value

Standard insurers often cap vehicle replacement values. For a rare Bugatti, Aston Martin, or Lamborghini, that cap simply isn’t enough. High-value policies can cover agreed value protection, ensuring the policyholder receives the full appraised value in the event of a total loss.

2. Customized and Limited-Edition Vehicles

Many celebrities drive cars with custom modifications — from diamond-studded interiors to one-of-a-kind paint jobs. Specialty insurance accounts for these upgrades, covering their custom parts and craftsmanship in case of damage.

3. Higher Exposure to Risk

Celebrities often face risks that most people don’t, such as:

- Overzealous fans or paparazzi accidents

- Theft or vandalism of their vehicles

- Unauthorized joyrides by staff or mechanics

Comprehensive celebrity car insurance offers wider protection for these unique exposures.

4. Global Mobility

Many high-profile individuals split their time between countries, which means their insurance must include international coverage — ensuring protection across borders.

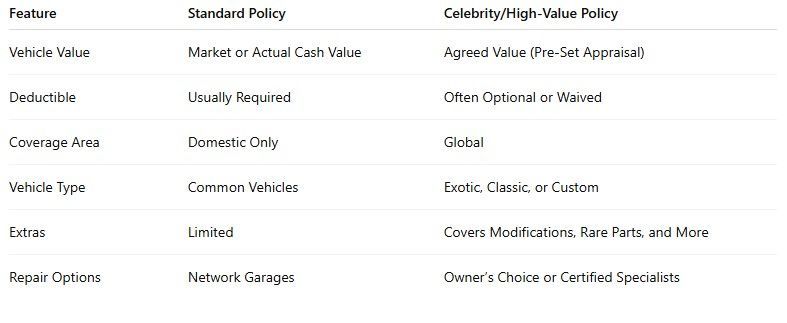

What’s Typically Covered in Car Insurance

Specialty auto policies for the rich and famous tend to include broader and more flexible terms than standard ones.

Here are some of the most common coverage features:

- Agreed Value Coverage:

Guarantees full payout of the car’s appraised worth if it’s totaled.

- Worldwide Coverage: Protection for vehicles stored, transported, or driven abroad.

- Custom Parts and Accessories: Covers luxury upgrades, from sound systems to interiors.

- Collector and Vintage Protection:

Ideal for rare or antique cars stored in private collections.

- No-Deductible Options:

Some policies eliminate deductibles altogether.

- Rental Replacement: Provides a high-end rental car during repairs (sometimes another luxury model).

- Security and Storage Coverage: Protects cars stored in private garages or display facilities.

Real-Life Examples: Celebrities and Their Coveted Rides

- Jay Leno:

With one of the world’s most famous car collections, Jay Leno reportedly insures hundreds of vehicles through specialty insurers like Hagerty.

- Kylie Jenner: Known for her custom Rolls-Royce and Lamborghini collection, her policies must cover unique paintwork and interiors.

- Cristiano Ronaldo:

His multi-million-dollar Bugatti Chiron requires international coverage due to his global travel.

- Jerry Seinfeld: A Porsche enthusiast, Seinfeld’s insurance ensures full appraised value and storage protection for his vintage collection.

These examples highlight that even for celebrities, insurance isn’t about luxury — it’s about protection and practicality.

Lessons Everyday Drivers Can Learn

Even if you don’t own a Lamborghini or Ferrari, there are valuable takeaways from celebrity car insurance practices:

- Know Your Vehicle’s True Value: If you’ve customized your car or own a collectible, make sure your policy reflects its full worth.

- Don’t Overlook Comprehensive Coverage: Theft, fire, and vandalism can happen to anyone.

- Consider Agreed Value Policies: This ensures you won’t lose money due to depreciation in a total loss situation.

Why Car Insurance Matters in Greenville, SC

Even though Greenville, SC may not be home to Hollywood superstars, it’s a growing hub for car enthusiasts, collectors, and successful professionals who own luxury or custom vehicles. Local insurance providers in Greenville, SC can help residents find high-value car insurance policies that include features like agreed value coverage, international protection, and repair flexibility — without the celebrity price tag.

Final Thoughts

Celebrities may have different lifestyles, but when it comes to protecting their cars, the principles are the same — insurance is about safeguarding what matters most. Whether it’s a million-dollar Ferrari or a cherished family car, the right coverage ensures peace of mind, financial security, and the freedom to drive with confidence.

For drivers in Greenville, SC, understanding how the rich and famous insure their rides offers valuable insight: tailor your coverage to fit your car, your risks, and your lifestyle. After all, you don’t need to be a celebrity to protect your prized vehicle like one.

At Priority Insurance LLC, we put our clients first by offering them policies that they can afford. Having insurance is a necessity nowadays, and we're here to help you out. Learn more about our products and services by calling our agency at (864) 297-9744. You can also request a free quote by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.