Running a business means managing people—and anytime people work together, misunderstandings, disagreements, and disputes can arise. Even when employers do everything right, the workplace can still become a source of legal claims. Allegations related to hiring, firing, promotions, harassment, or workplace conduct can be costly—even if the claims are unfounded. That’s where Employment Practices Liability Insurance (EPLI) comes in.

EPLI helps protect businesses from the financial consequences of employee-related lawsuits. Whether you have 3 employees or 300, understanding EPLI’s role can help shield your organization from unexpected legal risk.

What Is EPLI?

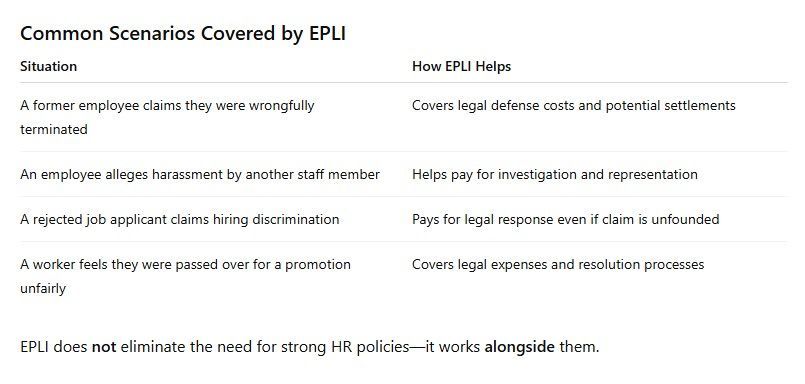

Employment Practices Liability Insurance (EPLI) is a type of insurance that provides coverage when employees—or sometimes job applicants or customers—bring claims against your business for workplace-related issues such as:

- Wrongful termination

- Discrimination

- Harassment

- Failure to promote

- Retaliation

- Improper hiring procedures

- Hostile work environment

This coverage helps pay for:

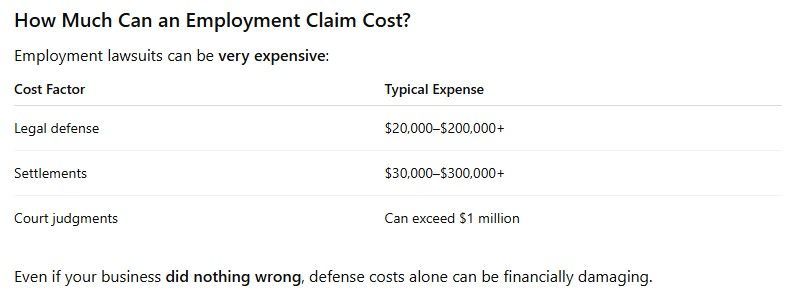

- Attorney fees

- Court costs

- Settlements or judgments (when covered)

Even a claim that is ultimately dismissed can cost thousands of dollars in legal defense.

Why EPLI Matters in Today’s Workplace

Workplace culture and employment laws are constantly evolving. Meanwhile, employees today are more informed about their rights than ever before.

Even well-managed businesses face risks, such as:

- Misunderstood communication

- Supervisor decision-making errors

- Differing interpretations of policies

- Cultural or interpersonal conflicts

- Shifts in legal standards and compliance expectations

EPLI offers critical protection when human relationships—and human error—intersect with workplace operations.

Who Needs EPLI?

Businesses of all sizes can benefit from EPLI, but it’s especially important for:

- Small and mid-sized businesses without dedicated HR departments

- Companies experiencing growth, restructuring, or turnover

- Industries with customer-facing or team-based environments

- Businesses with seasonal, temporary, or contract workers

If your business has employees, you have EPLI exposure.

Local Note for Businesses in Greenville, SC

In Greenville, SC, businesses across sectors—manufacturing, healthcare, hospitality, professional services, and retail—regularly manage diverse teams and customer interactions. Because workplace standards and employment law compliance can vary by industry, EPLI provides valuable protection against claims that could otherwise threaten business stability and reputation.

Best Practices to Reduce EPLI Claims

EPLI works best when combined with strong workplace management.

Key Prevention Strategies:

- Develop and maintain clear employee handbooks

- Conduct consistent supervisor and HR training

- Document performance conversations and disciplinary actions

- Create thorough reporting and investigation procedures

- Encourage an open-door communication culture

Prevention reduces claim frequency—and can lower EPLI premium costs.

How EPLI Fits Into Your Overall Insurance Strategy

EPLI complements other business insurance policies, including:

- General Liability (covers physical injury/property damage—not employment disputes)

- Workers Compensation

(covers employee injury—not lawsuits or complaints)

- Directors & Officers Insurance (protects leadership from governance-related claims)

Each policy addresses different risks. EPLI fills the gap related to workplace conduct and employment practices.

Conclusion

Employment-related disputes are a reality in modern business. Even with strong policies, fair leadership, and positive culture, misunderstandings and claims can occur. EPLI provides the financial protection and legal support your business needs to handle these challenges without jeopardizing operations or stability.

By investing in EPLI, your business is not just protecting itself—it’s reinforcing a workplace environment built on fairness, professionalism, and accountability.

At Priority Insurance LLC, we put our clients first by offering them policies that they can afford. Having insurance is a necessity nowadays, and we're here to help you out. Learn more about our products and services by calling our agency at (864) 297-9744. You can also request a free quote by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.